capital gains tax news canada

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. On a capital gain of 50000 for instance only half of that amount 25000 is taxable.

Canada Capital Gains Tax Attribution Rules In Canada Versus The Us

On August 9 2022 the Canadian federal government released a package of draft legislation to implement various tax measures update certain previously released draft legislation and make certain technical changes Proposal.

. If you sell qualifying shares of a Canadian business in 2021 the LCGE is 892218. The origin of capital gains taxation in Canada can be traced to the Carter commission appointed in September 1962 to thoroughly review the Canadian tax system. The commission acknowledged that the taxation of.

When you sold the 100 shares this year you received 50 per share and paid a 50 commission. Because you only include onehalf of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 500000 half of 1000000. On 29 June 2021 private members Bill C-208 An Act to amend the Income Tax Act transfer of small business or family farm or fishing corporation received Royal AssentBill C-208 contains amendments to provide exceptions to the application of the capital gains stripping and anti-surplus stripping rules in sections 841 and 55 of the Income Tax Act.

Investors pay Canadian capital gains tax on 50 of the capital gain amount. Multiply 5000 by the tax rate listed according to your annual income minus any. One tax-efficient strategy for individuals to realize capital gains is selling the securities to a new or existing Canadian holding company in exchange for shares with an equivalent fair market.

Your sale price 3950- your ACB 13002650. For example on a capital gain of 10000 half of that or 5000 would be taxed based on the individuals tax bracket and the. The listed personal property rules state that coins with a resale value and gain of 1000 or less are exempt from capital charges.

Subject to parliamentary approval the tax will apply beginning on September 1 2022. Capital Gains Taxation in Canada. NDPs proto-platform calls for levying.

The sale price minus your ACB is the capital gain that youll need to pay tax on. January 1 2022 marks the 50th anniversary of the capital gains tax in Canada. The taxable portion of 125000 250000 capital gain x 50 inclusion rate is taxed at your marginal tax rate.

Since its more than your ACB you have a capital gain. The capital gains tax is the same for everyone in canada currently 50. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000.

For example on a capital gain of 10000 half of that or 5000 would be taxed based on the. This means that if you earn 1000 in capital gains and you are in the highest tax bracket in say Ontario 5353 you will pay 26765 in Canadian capital gains tax on the 1000 in gains. In Canada 50 of the value of any capital gains is taxable.

This means that if you earn 1000 in capital gains and you are in the highest tax bracket in say Ontario 5353 you will pay 26765 in Canadian capital gains tax on the 1000 in gains. Investors pay Canadian capital gains tax on 50 of the capital gain amount. History and Potential Reforms.

Your capital gain is 5000. However you would be allowed to claim CCA expense of the undepreciated building cost 4 subject to income limitations to offset a portion of rental income each year until Year 5. In our example you would have to include 1325 2650 x 50 in your income.

Bullion and coins are liable to capital gains tax across Canada subject to personal-use property exemptions. Capital gains tax news canada Monday May 9 2022 Edit. Having no tax charge is a huge advantage and why buying bullion in Canada is sought after.

And the tax rate depends on your income. The total amount you received when you sold the shares was 5000. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in.

In 1966 the commissions report recommended among other things that a tax be imposed on capital gains. The capital gains tax rate in Ontario for the highest income bracket is 2676. Your new cost basis as of Year 5 would be 850000.

If you earned a capital gain of 10000 on an investment 5000 of that is taxable. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax. In this article we outline the history of capital gains taxation in Canada describe some of the key features of the current system and comment on potential reforms.

When you make a profit from selling a small business a farm property or a fishing property the lifetime capital gains exemption LCGE could spare you from paying taxes on all or part of the profit youve earned. The draft legislation includes measures first announced in the 2022 Federal Budget with updated versions of draft.

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Capital Gains Tax In Canada Explained

2022 Capital Gains Tax Rates In Europe Tax Foundation

Inheriting A Secondary Residence Some Planning May Be Required Sfl Wealth Management Sfl Investments

How High Are Capital Gains Taxes In Your State Tax Foundation

Canada Crypto Tax The Ultimate 2022 Guide Koinly

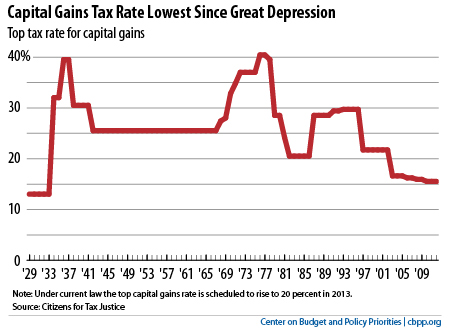

Chart Book 10 Things You Need To Know About The Capital Gains Tax Center On Budget And Policy Priorities

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Crypto Taxation In Canada 2022 Ultimate Guide Ocryptocanada

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Capital Gains Tax Calculator 2022

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Canada Crypto Tax The Ultimate 2022 Guide Koinly